Hewlett Packard Enterprise (HPE) updated its switch and access point portfolio that tie into recent software launches, but more interestingly is making pointed attacks at competing platforms from rivals Cisco and Broadcom-VMware.

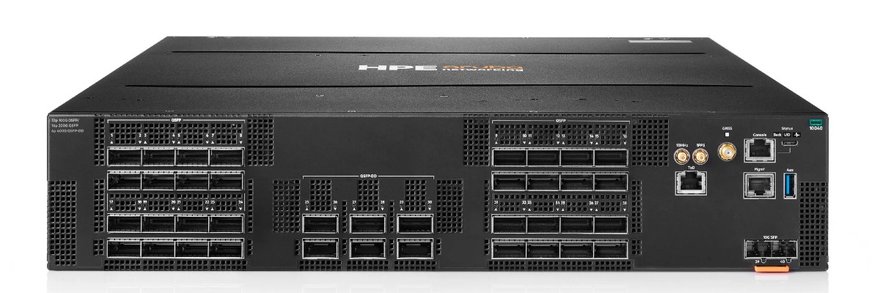

The updated components include a new Aruba Networking CX 10040 switch that continues to use AMD Pensando digital processing units (DPUs) but now supports double the scale and performance of the previous-generation unit. This is touted as being able to support growing artificial intelligence (AI) usage.

John Gray, head of global marketing for HPE Aruba, explained that the new switch builds on the initial CX 10000-series launched in late 2021. This was dubbed a “distributed services switch” that consolidated networking functions and management into a single form factor.

Gray explained that the new switch can support 100 Gb/s and 400 Gb/s Ethernet, is powered by four AMD Pensando DPUs, “and it opens up a whole new range of use cases that a higher scale-type platform of this type provides usage to, like 100-gig server, top of rack, data center, interconnect.”

“Many customers aren't necessarily building out brand new data centers anymore, but what they're doing is they're hosting their compute, and their storage, and their services in places like Equinix and Digital Realty Trust, or colocated servers, or racks, or cages, and in those environments, for those customers, rather than having to deploy separate switches and separate – think Palo Alto firewalls or Fortinet firewalls – they can combine that function into a single [one rack unit or two rack unit] form factor that does the switching, the routing, and the security services at scale for really a fraction of the cost that they otherwise would have had to deploy that,” Gray added.

More pointedly, Gray said the new product bolsters HPE’s position in the “smart switch market category” that rivals like Cisco have only jumped into. This was in reference to Cisco’s recently launched N9300-series smart switches that also use AMD Pensando DPUs.

“We're welcoming Cisco to the party,” Gray said. “They just announced something, although they're not shipping anything yet, and when they do ship it, my understanding is it's not going to have anywhere near the functionality that what we have been shipping for the last couple of years. It's only going to be zone-based firewalling with the need of a Hypershield license on top of that to enable the DPUs. It'll be interesting, and we welcome the competition.”

Gray did note that HPE’s market advantage was boosted by its initial exclusivity arrangement with Pensando, which dated to before the DPU provider was acquired by AMD for $1.9 billion.

Gray also explained that the updated switches play in slightly different environments than those from other rivals like Arista Networks and Juniper Networks. This includes Arista focusing more on the hyperscale market as opposed to HPE’s focus on the enterprise, and Juniper focused more on the service provider space, “so different priorities.”

While throwing barbs, Gray also explained that the new platform can support HPE’s recently updated Morpheus VM Essentials platform that provides a way for customers to use HPE equipment in support of virtual machine (VM) deployments. Gray said this is targeted at disgruntled VMware customers that “may be struggling with their VMware estate right now and pricing and getting locked into long-term service agreements” due to Broadcom’s licensing changes.

“Now they can turn to an open source, KVM-based alternative in a full stack way,” Gray said. “They can still cap and maintain that ESX hypervisor environment that they have, but they can begin to grow in a different direction with a product like Morpheus, and we've done integration specifically now with the CX 10000 portfolio to replace the network and security virtualized functionalities that NSX would otherwise provide in part of that, so think distributed firewall, microsegmentation, all the encryption capability … for a fraction of the cost.”

While somewhat salacious, HPE’s bravado is somewhat tempered by a recent Gartner Magic Quadrant ranking of data center switch vendors. HPE was placed in the “challengers” box of that ranking alongside Nvidia, but under market “leaders” Arista, Cisco, Huawei, and Juniper.

Gartner in ranking HPE’s Aruba CX-Series switches, AOS-CX operating system, and Aruba fabric management, touted the vendor’s “solid portfolio,” market investment, large installed base, and robust channel partner support. However, it dinged HPE for releasing mundane feature updates, the lack of commercial support for the SONiC ecosystem, limited market visibility among Gartner clients.

HPE’s other updates

HPE also launched a new CX 6300-series campus switch, which includes four options targeted at varying security and bandwidth demands. They all are packaged in a smaller footprint for easier deployment in space-constrained environments.

There is also a new pair of Wi-Fi 7 access points (APs) that are “skinnier” versions of already available models. The new APs are the 740 model, which is a slimmed-down version of the already available 750 model, and the new 720 model, which is a more basic 730 model.

Gayle Levin, who heads up product marketing for HPE Aruba’s wireless portfolio, explained that these new models hit a customer need.

“We realized that a lot of our customers wanted to move to Wi-Fi 7 didn't need all the bells and whistles. This gives them an opportunity to move and future-proof their environments at a more cost-effective price point,” Levin said, adding that this may lead to some cannibalization of the higher-priced models, “but it's really important to make sure that we can make it available to everyone who needs it.”